…Decline likely to undermine economic reform plans, demand concerns

By Charles Ebi

A sharp drop in global oil prices, aggravated by deepening trade tensions between the United States and China, could cost Nigeria an estimated ₦1.8tn in lost revenue in 2025, analysts at BMI, a Fitch Solutions company, have warned.

The analysts say the projected shortfall equivalent to 4.8% of Nigeria’s 2025 federal revenue estimate could severely undermine the Federal Government’s economic and security reform ambitions.

Although, the reimposition of U.S. tariffs has had only a marginal direct impact on Nigerian exports since crude oil, which makes up about 90% of exports to the U.S., remains exempt fears of a global economic slowdown have led to a downward revision in oil price forecasts.

BMI’s Oil & Gas team has revised its Brent crude projection for 2025 from $76 to $68 per barrel. The resulting revenue loss could strain an already tight fiscal position and weaken Nigeria’s capacity to fund crucial national programmes.

BMI analysts have raised concerns that declining oil income could further jeopardize efforts to overhaul Nigeria’s underfunded military. In 2023, military spending was just 0.8% of GDP among the lowest globally leaving the country’s armed forces grappling with outdated equipment, limited intelligence capabilities, and morale issues caused by salary delays and poor conditions.

With insecurity on the rise, including Islamist insurgencies in the Northeast, banditry in the Northwest, and separatist unrest in the Southeast, the analysts caution that reduced funding could delay or derail reform plans aimed at stabilizing the country.

Beyond defence, the looming fiscal squeeze may also hinder broader socioeconomic reforms aimed at tackling root causes of insecurity such as poverty, joblessness, and inadequate public services.

“Unless these structural issues are addressed”, BMI warned, “2025 could see no meaningful improvement in Nigeria’s security landscape particularly after one of the country’s most violent years on record in 2024″.

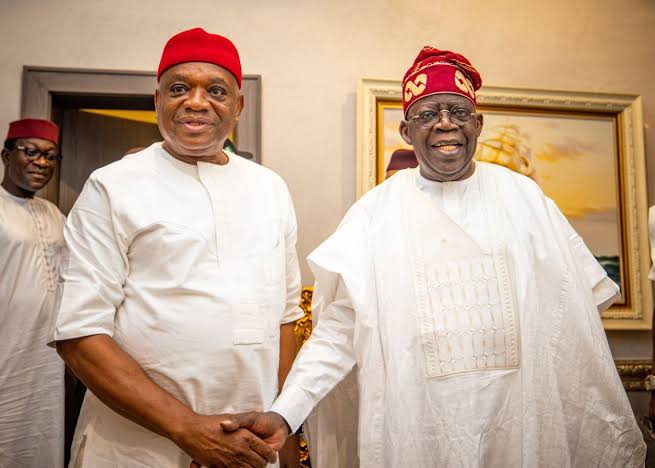

The revenue threats are especially significant in oil-producing regions like Rivers State, where political tensions have already disrupted crude output. President Bola Tinubu declared a state of emergency in March 2025 and removed Governor Siminalayi Fubara following widespread instability and vandalism of oil infrastructure.

Analysts fear the Federal Government may resort to aggressive military strategies to secure pipelines and installations in the South-South moves that risk escalating tensions and provoking civil unrest among local communities.

“With global oil prices falling, maintaining steady production from volatile regions like Rivers State is now more critical than ever”, the report said.

In response to waning U.S. engagement in Sub-Saharan Africa, BMI projects that Nigeria will pivot further toward China. Recent bilateral developments include a $3.3 billion industrial park deal, a $255m loan from the China Development Bank for the Kano-Kaduna railway project, and growing defence cooperation between the two countries.

While a full disengagement from the U.S. is unlikely, Nigeria is clearly seeking to diversify its international alliances to attract investment and stabilize its economy.

The Federation Account Allocation Committee ,FAAC, recorded a total revenue inflow of ₦7.4tn for the first quarter of 2025, driven by improved oil receipts, tax reforms, and foreign exchange gains.

Of this amount, ₦4.96tn was disbursed as statutory allocations to the Federal Government, 36 states, and 774 local government areas between January and March. The Federal Government received ₦1.65tn, state governments ₦1.68tn, and local governments ₦1.22tn. Oil-producing states received ₦393.93bn under the 13% derivation principle.

Reacting to the oil price slump, Finance Minister Wale Edun confirmed that the Federal Government would focus on essential expenditures, including salaries, pensions, statutory transfers, debt servicing, and defence.

“Our budget was based on two million barrels per day at $75 per barrel. We are now underwater relative to those assumptions”, Edun stated. “When your revenue falls short, you have to hunker down, conserve, and prioritise”.

To bridge the fiscal gap, Edun said the government would pursue asset sales, public-private partnerships, and increased privatisation efforts. He noted that investor interest had already surpassed projections, raising hopes of offsetting part of the revenue shortfall.

President Tinubu’s broader economic strategy, he said, remains focused on restoring stability, stimulating investment, and fostering job creation and poverty alleviation even amid tightening fiscal space.

However, in the global commodity market, prices of crude oil eased on Tuesday amidst elevated demand concerns amidst OPEC+ production ramp up decision. Oil prices are sliding amidst growing concerns that US President Donald Trump’s protectionist trade policies could stoke inflation and dampen oil demand in the world’s largest consumer.

International benchmark Brent crude decreased by around 0.45%, trading at $64.64 per barrel, down from $64.93 at the previous session’s close. Similarly, US benchmark West Texas Intermediate ,WTI, fell by about 0.45%, settling at $62.21 per barrel, compared to $62.49 in the prior session.

Trump announced a major increase on Friday in tariffs on steel and aluminum imports, doubling the rate from 25% to 50%, in what he described as a move to further protect American industry. During a rally at a US Steel facility in Pittsburgh, Pennsylvania, he argued that the increase would close gaps that foreign competitors have used to bypass previous tariffs.

Experts warn that such measures could fuel inflationary pressures and slow economic growth, weakening demand appetite and putting downward pressure on oil prices. The European Union has expressed deep concern over a decision by the US to double tariffs on steel imports, warning that it may impose retaliatory measures unless a negotiated solution is reached.

In a statement Monday, European Commission spokesperson Olof Gill said the EU “strongly regrets” Washington’s move to raise tariffs on steel from 25% to 50%, calling it a step that “adds further uncertainty to the global economy and increases costs for consumers and businesses on both sides of the Atlantic”.

As attention shifts to demand side, key US labor market data, a crucial indicator of economic momentum is also under investor scrutiny. The US JOLTS job openings data due on Tuesday will kick off a week of employment figures that may shape market expectations.

Analysts caution that signs of a weakening labor market could heighten recession fears in the US, potentially further eroding demand outlook and contributing to falling oil prices.