From Rotimi Asher

Citing Dangote Industries’ inability to refinance maturing debt, Fitch Ratings has withdrawn the company’s National Long-Term Rating and senior unsecured rating of ‘B+,nga’ while maintaining them on Rating Watch Negative ,RWN.

The rating agency said in a statement posted on its website that the RWN was not resolved due to the pending refinancing of the company’s maturing debt.

Following the inability to resolve the RWN, Fitch said it will no longer provide ratings or analytical coverage for Dangote and has withdrawn them for commercial reasons.

It said the key rating drivers would no longer be applicable as the ratings have been withdrawn.

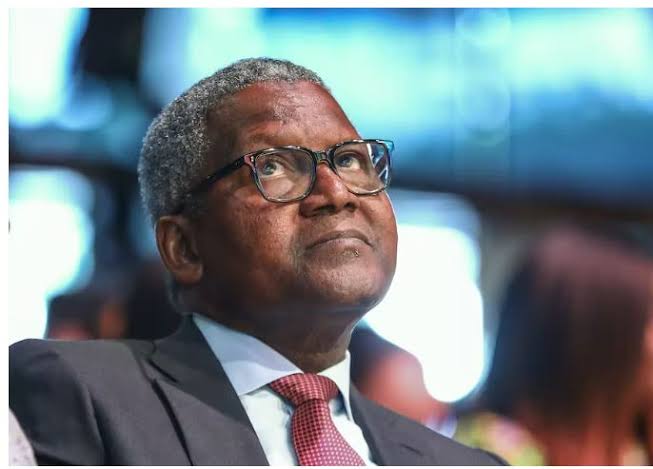

Dangote is a conglomerate based in Nigeria and West Africa. Its key business segments are cement, fertiliser, oil refining and food.

The statement reads, “Fitch Ratings has withdrawn Dangote Industries Limited’s ,Dangote, National Long-Term Rating and senior unsecured rating of ‘B+,nga,’ while maintaining them on Rating Watch Negative ,RWN.

“The RWN was not resolved due to the pending refinancing of the company’s maturing debt. Fitch will no longer provide ratings or analytical coverage for Dangote and has withdrawn them for commercial reasons”.

The withdrawal implies that Fitch Ratings will no longer assess or publish opinions on the company’s creditworthiness. The reason for withdrawal could be due to various factors.

Before withdrawing the rating, Fitch had confirmed that DIL’s National Long-Term Rating and senior unsecured rating were at B+,nga, which suggests a speculative credit quality with some risk.

Despite confirming the ratings, Fitch kept Dangote on Rating Watch Negative ,RWN, before withdrawal. RWN signals a potential downgrade due to concerns about financial stability, liquidity, or other credit risks.

The withdrawal could raise concerns among investors, especially since the company was on RWN, meaning there were already downside risks.

If other rating agencies follow suit, lenders and investors might view Dangote Industries as a higher-risk borrower, potentially increasing its cost of borrowing.

Stakeholders, including shareholders and bondholders, may speculate on the reasons for the withdrawal, possibly affecting the company’s stock or bond prices.

While the exact reasons were not stated, the fact that Fitch had a negative outlook before withdrawal might hint at financial or operational concerns.

Recall that Fitch Ratings had, in August last year downgraded Dangote Industries Limited’s creditworthiness due to “significant deterioration in the group’s liquidity position following lower-than-expected disposal proceeds”.

The global rating institution had placed Dangote’s ratings on a negative watch and lowered the company’s national long-term rating to B+,nga, from AA,nga.

A negative watch in credit ratings indicates that a company’s ability to repay may be deteriorating. It is a signal that the company’s outlook is not stable and there may be increased risks, according to Investopedia.

Fitch said, “Lack of tangible steps to refinance or repay the maturing debt would lead to further downgrade while we do not expect a positive rating action until the company’s liquidity position improves substantially”.