…As WTO rates Nigeria’s average GDP growth rate since 2014

By Charles Ebi

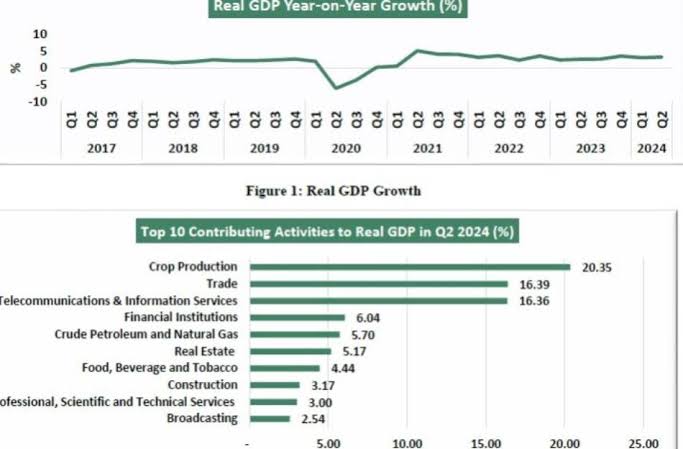

Nigeria’s Gross Domestic Product ,GDP, grew by 3.19% ,year-on-year, in real terms in the second quarter of 2024, the National Bureau of Statistics has said.

The Bureau said that the growth rate is higher than the 2.51% recorded in the second quarter of 2023 and higher than the first quarter of 2024 growth of 2.98%.

The performance of the GDP in the second quarter of 2024 was driven mainly by the Services sector, which recorded a growth of 3.79% and contributed 58.76% to the aggregate GDP.

The agriculture sector grew by 1.41%, from the growth of 1.50% recorded in the second quarter of 2023. The industry sector’s growth was 3.53% an improvement from -1.94% recorded in the second quarter of 2023.

In terms of share of the GDP, the industry and services sectors contributed more to the aggregate GDP in the second quarter of 2024 compared to the corresponding quarter of 2023.

In the quarter under review, aggregate GDP at basic price stood at N60.93tn in nominal terms. This performance is higher when compared to the second quarter of 2023 which recorded aggregate GDP of N52.1tn, indicating a year-on-year nominal growth of 16.94%.

In terms of oil output, the NBS report stated that the nation in the second quarter of 2024 recorded an average daily oil production of 1.41 million barrels per day (mbpd), higher than the daily average production of 1.22 mbpd recorded in the same quarter of 2023 by 0.19 mbpd and lower than the first quarter of 2024 production volume of 1.57 mbpd by 0.16mbpd.

The report added, “The real growth of the oil sector was 10.15% ,year-on-year, in Q2 2024, indicating an increase of 23.58% points relative to the rate recorded in the corresponding quarter of 2023 ,-13.43%

“Growth increased by 4.45% points when compared to Q1 2024 which was 5.70%. On a quarter-on-quarter basis, the oil sector recorded a growth rate of -10.51% in Q2 2024.

“The Oil sector contributed 5.70 per cent to the total real GDP in Q2 2024, up from the figure recorded in the corresponding period of 2023 and down from the preceding quarter, where it contributed 5.34% and 6.38% respectively”.

The report noted further that the non-oil sector grew by 2.80% in real terms during the reference quarter, adding that this rate was lower by 0.78 percentage points compared to the rate recorded in the same quarter of 2023 which was 3.58%.

“This sector was driven in the second quarter of 2024 mainly by financial and insurance; Information and Communication; agriculture; trade; and manufacturing, accounting for positive GDP growth.

“In real terms, the non-oil sector contributed 94.30% to the nation’s GDP in the second quarter of 2024, lower than the share recorded in the second quarter of 2023 which was 94.66% and higher than the first quarter of 2024 recorded as 93.62%”.

Reacting to the GDP growth rate, some financial experts said the figure is a positive sign for economic recovery.

The experts expressed hope that this positive trend would continue in the coming quarters, ultimately leading to more diversified and sustainable economic growth for Nigeria.

The Group Managing Director of Crane Securities Limited, Mr. Mike Eze, has commented on Nigeria’s recent economic performance, describing the country’s Gross Domestic Product ,GDP, growth of 3.19% year-on-year in real terms for the second quarter of 2024 as both expected and a welcome development.

In an interview Mr. Eze emphasized Nigeria’s position as the strongest economy in Africa, attributing the GDP growth to a range of ongoing financial strategies aimed at restructuring the nation’s economic system.

“Nigeria remains the leading economy on the continent, and there are significant financial engineering efforts underway to revamp and strengthen our economic framework”, Eze stated.

However, he noted that the government is currently grappling with several economic challenges, including the devaluation of the naira, a persistent foreign exchange crisis, the removal of fuel subsidies, and increases in electricity tariffs.

These issues have had a substantial impact on both the economy and the populace, creating a complex economic landscape.

Discussing the relationship between economic policy and GDP growth, Eze explained that, in times of inflation and economic downturn, it is common for experts to advise governments to borrow funds.

“The process of borrowing and subsequent spending can stimulate economic activity, which often leads to an increase in GDP”, he noted.

“This growth is primarily a result of increased government expenditure and investment”.

Eze further elaborated that the recent GDP growth reflects the immediate effects of such borrowing and spending, suggesting that these measures have begun to positively influence the economy.

“The rise in GDP by 3.19% indicates that the economy is responding to these fiscal policies, and we can anticipate further growth in the coming quarters”, he said.

Despite the challenges, Eze remains optimistic about Nigeria’s economic prospects, forecasting continued growth as the country navigates its current economic restructuring efforts.

The former President of the Chartered Institute of Stockbrokers ,CIS, and Managing Director of Arthur Steven Asset Management Limited Mr. Olatunde Amolegbe also described Nigeria’s recent GDP growth as a “pleasant surprise”.

However, he expressed concerns over the fact that this growth was primarily driven by increases in oil production, which he views as providing limited long-term relief.

“While the GDP growth is certainly a positive development, I would have preferred to see a more significant contribution from the non-oil sectors”, Amolegbe stated.

Amolegbe emphasized that complementary growth in sectors such as manufacturing, transport, agriculture, and services would have provided a more robust and sustainable boost to the GDP.

“Unfortunately, these sectors are currently facing headwinds due to elevated interest rates and rising inflation, which are creating a drag on their performance”, he explained.

Despite these concerns, Amolegbe acknowledged the importance of the recent growth, describing it as a “welcome baby step” towards economic recovery.

He expressed hope that this positive trend would continue in the coming quarters, ultimately leading to more diversified and sustainable economic growth for Nigeria.

Also speaking, Nigeria’s first Professor of Capital Market, Uche Uwaleke noted that the aggressive hike in monetary policy rate in February and March 2024 by the CBN took a toll on output in Q2 2024.

According to Uwaleke, this may explain the decline recorded in major contributors to GDP such as Manufacturing, Trade, ICT and Real Estate.

He said, “The impact of high cost of petroleum products manifested in the huge decline in Transport GDP from 3.33% to -13.53%.

“Just like in Q1 2024, when growth was driven by the oil sector, growth in Q2 2024 was also driven by the oil sector at 10.15%.

“Oil sector growth was aided largely by the increase in crude oil price during the quarter as average crude oil production fell (from 1.57mbpd in previous quarter to 1.41mbpd)

“Manufacturing and agriculture sectors appeared hugely impacted by economic headwinds during the quarter. Growth rates were a mere 1.28% and 1.41 prespectively.

“The agric sector (comprising 4 activities although dominated by crop production) improved in Q2 2024 to 1.41% from 0.18% in the previous quarter.

“The financial sector grew by 28.79%, a clear demonstration that it is detached from the productive sectors of the economy.

Meanwhile, the Director General of the World Trade Organization ,WTO, Ngozi Okonjo-Iweala, has observed that Nigeria’s Gross Domestic Product ,GDP, growth rate on average has been steadily declining since 2014, signalling a downturn in the economic well-being of the average Nigerian.

Okonjo-Iweala, speaking at the annual General Conference of the Nigerian Bar Association ,NBA, on Sunday, noted that the country’s economic fortunes experienced a reversal following the decade between 2000 and 2014, during which the average GDP growth rate was approximately 3.8%.

According to the Director-General of the WTO, this consistent GDP growth outpaced the nation’s population growth, which was only around 2.6% annually.

However, she pointed out that since 2014, the situation has reversed, with GDP showing a negative growth rate of 0.9%, as the government has been unable to sustain the positive growth achieved by previous administrations.

“Many of the big problems the NBA is grappling with today has its root in Nigeria’s failure to sustain the rate of economic growth and development that consistently outpaced the growth of the population.

“We have had episodes of reforms and faster economic growth that was not merely a function of the price of oil. But we have been unable to consolidate and build on them and millions of our compatriots have paid the price in terms of diminished job prospects and human well-being.

“For example, in the decade between 2000 and 2014, we have an average GDP growth rate of 3.8% well above our population growth rate of 2.6% per annum, meaning that people were on average truly improving their standard of living.

“During the following decade, average annual GDP per capita has been negative around minus 0.9% meaning people were worse off because we were not able to sustain prior positive growth momentum”, Okonjo-Iweala added.

Speaking further, Okonjo-Iweala said the country needs to sustain good economic policies irrespective of the administration or political party in power in order to foster development in the country.

The former Finance Minister said policy inconsistencies have accounted for the reversal in the fortune of the nation’s economic development.

Furthermore, she advocated for a social contract between the government and the people which will go beyond the political party in power.

According to her, this social contract must be generally accepted on what economic policies should be followed regardless of who is in power.

“Maintaining good economic and social policies; maintaining policy consistency and adding more reforms on top of that will lead us along the path of good progress that we all desire”, she added.

Nigeria’s Gross Domestic Product ,GDP, growth declined to 2.98%, lower than the rate recorded in the fourth quarter of 2023 which was 3.46%, according to a report from the National Bureau of Statistics ,NBS.

However, the GDP growth rate in the quarter is higher than the figure recorded in the corresponding quarter of 2023 which was 2.31%.

Decades ago, Nigeria’s economic growth has been moderate as a result of low exports, a reduction in the sales of oil which accounts for about 90% of our revenue as well as other economic challenges in the country.

Meanwhile, President Bola Tinubu has continuously said he would increase Nigeria’s GDP to a $1 trillion economy, but many analysts believe such a goal may not the feasible amid growing concerns of high inflation, low employment rate as well and rising national debt.