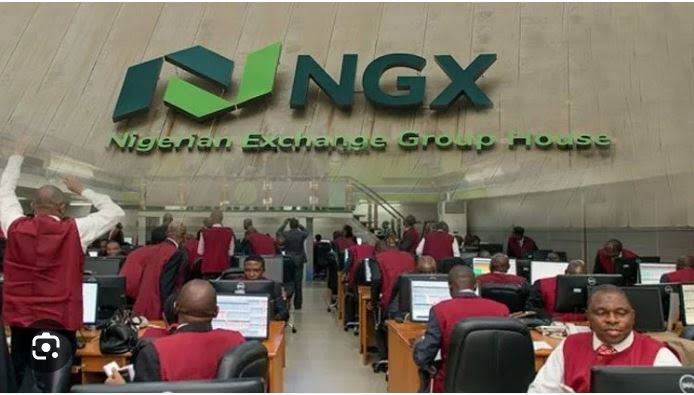

Nigerian stock market recorded a total domestic transaction value of N2.5tn for the first half of the year.

According to the latest report from the Nigerian Exchange Limited the data highlights the increasing dominance of local investors over their foreign counterparts, emphasizing a shift in the dynamics of the Nigerian capital market.

The report shows that domestic transactions accounted for 80.68% of the total market activity, while foreign transactions contributed just 19.32%.

Although foreign participation slightly increased from the 8.62% recorded in the previous year, local investors continue to lead the market. The cumulative N2.5tn recorded in domestic transactions this year represents a growth of about 27% compared to N1.968tn during the same period last year.

A closer look at the monthly figures reveals variations in transaction volumes throughout the year. In January domestic transactions stood at N598.41bn, accounting for 91.85% of the total market activity. February saw a dip, with domestic transactions falling to N292.07bn, making up 81.61%.

Also, March recorded a recovery, as domestic transactions reached N444.28bn, representing 82.50% of total transactions. In April, domestic transactions dropped to N225.40bn or 65.10% of total market activity.

In the period under review, May’s domestic transactions slightly increased to N231.10bn, contributing 65.03%. June recorded N272.36bn in domestic transactions, making up 76.82% of market activity while July witnessed a surge, with domestic transactions rising to N434.09bn, a 59.38% increase from the previous month.

The rise in July’s figures was driven by increased retail investor participation, which saw a 138.48% growth from N114.02bn in June to N271.92bn in July. Institutional investor activity also grew, albeit more modestly, by 2.42%, from N158.34bn in June to N162.17bn in July.

While domestic transactions saw growth, foreign transactions experienced a decline. Year-to-date, foreign transactions totaled to N598bn, reflecting reduced interest from foreign investors. From June to July, foreign transactions dropped by 30.02% decreasing from N82.19bn to N57.52bn, highlighting the influence of foreign investors in the Nigerian stock market.

Looking at the longer-term trends, between 2007 and 2023, domestic transactions decreased by 10.94%, while foreign transactions fell by 33.28%. This trend illustrates how local investors have progressively taken the lead in market activities, supported by government policies, economic factors, and waning foreign interest.